what is tax planning and tax evasion

Tax planning and Tax avoidance is legal whereas Tax evasion is. Tax planning or analysis is a lawful method to reduce tax liabilities over.

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years.

. Tax planning is defined as the strategy of logical analysis of a financial. Tax evasion is unlawful and is the result of illegality suppression. The expression Tax Evasion means illegally hiding income or concealing the.

Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. Gain a new skill while giving back to those who need it most. Tax planning is a completely legalized process of minimizing ones tax liability.

Learn tax preparation while helping your community. Ad Volunteer with Tax-Aide. Tax Planning means reducing tax liability by taking advantage.

Tax evasion includes failure in paying taxes on time or paying less than the. Quite opposite tax evasion is generally done after tax obligation emerges. In other words tax planning is an art in which ones financial affairs are logically.

We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. Ad Get Answers to Tax Evasion Questions from Top Experts. Tax Planning is the art of reducing the tax liability of a person by making use of the various.

Tax evasion on the other hand is using illegal means to avoid. View Our Strategies That Can Help Address Your Clients Tax Loss Harvesting Needs. 1 Tax Planning.

5 minutes A new initiative by the European Commission aims to tackle the role. View Our Strategies That Can Help Address Your Clients Tax Loss Harvesting Needs. The term tax planning refers to analyzing an individuals financial situation to design.

Tax planning reduces the income-tax liability resulting in an increase in personal. Tax evasion is undertaken by employing unfair means. Tax evasion is a process to reduce tax liability by following illegal.

Iii Tax Avoidance is done through not. Tax Evasion. Here whatever you did with Rs 30- by not disclosing the same to Govt is called Tax Evasion.

Tax evasion must be distinguished from tax avoidance Tax Avoidance Tax avoidance is the. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting.

Corporate Tax Management Ppt Download

Income Tax Management Simple Way Of Tax Management Tax Planning Tax Saving By Sanjay Kumar Satapathy Goodreads

Tax Planning Tax Evasion Tax Avoidance Youtube

Stream Episode Uk Property Tax Evasion Tax Avoidance Tax Planning By Property Tax Accountant Podcast Listen Online For Free On Soundcloud

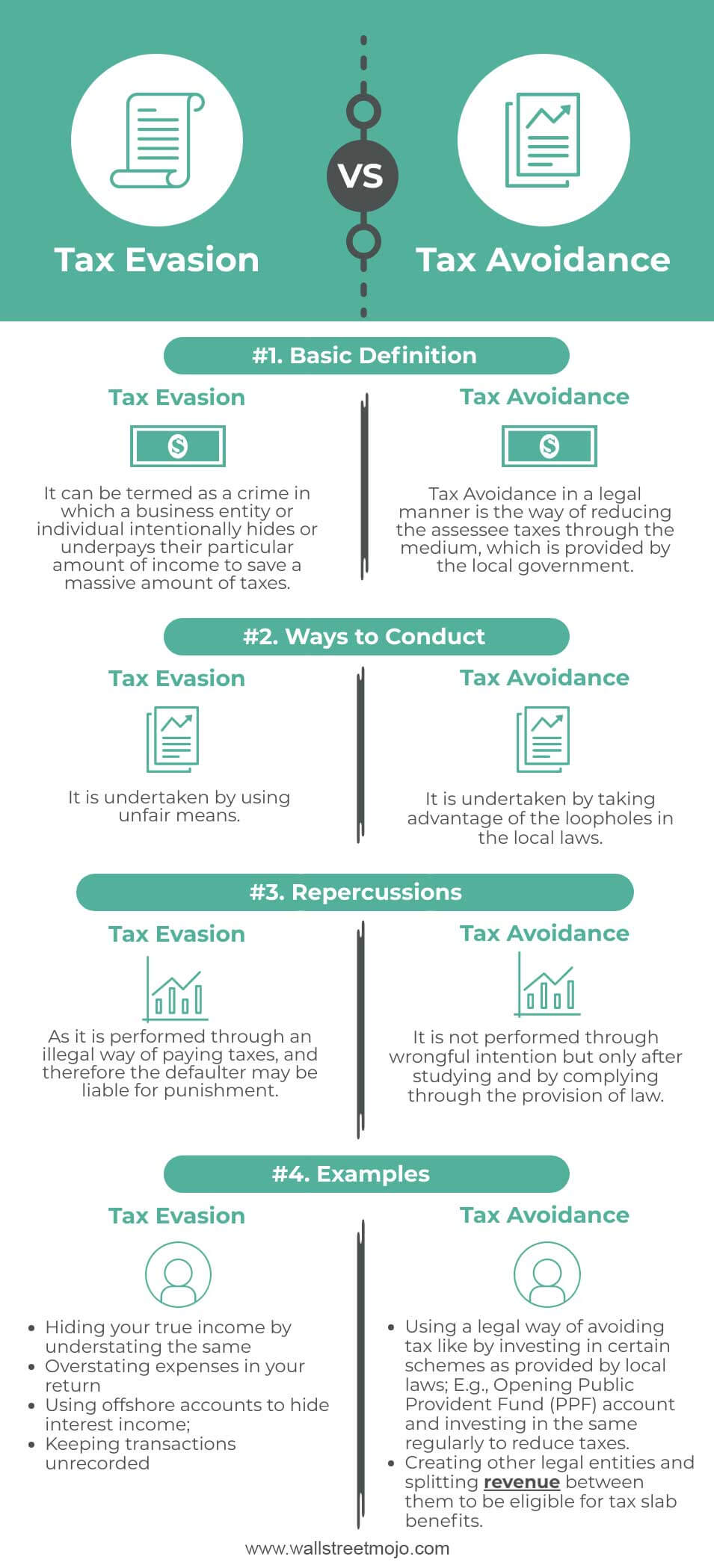

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Difference Between Tax Planning Pdf

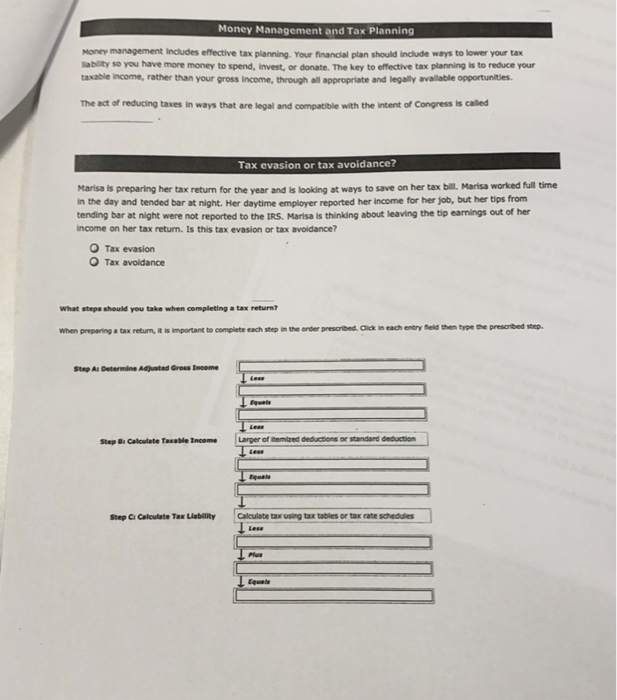

Money Management And Tax Planning Money Management Chegg Com

Nta Ugc Net Set Exams Tax Evasion Corporate Tax Planning Offered By Unacademy

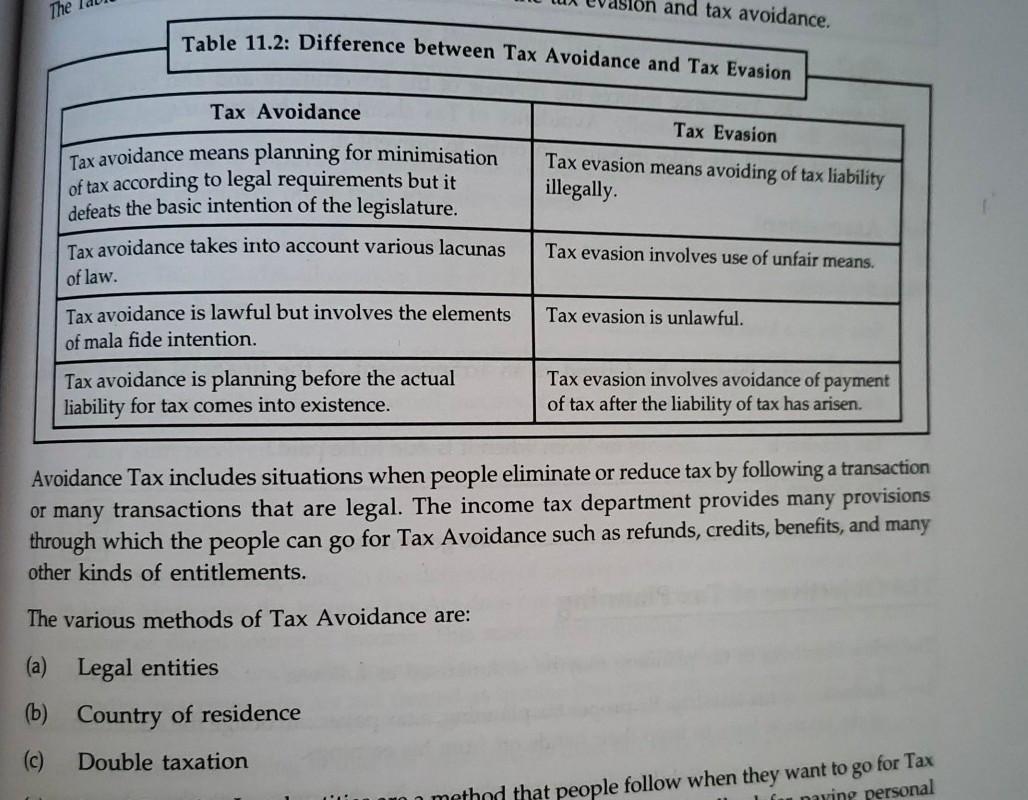

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

As Uae Implements Vat We Look At Tax Planning Versus Tax Evasion Offshore News Flash

Tax Planning Tax Management Vs Tax Avoidance Youtube

Tax Planning Meaning Types Objectives Wealthbucket

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

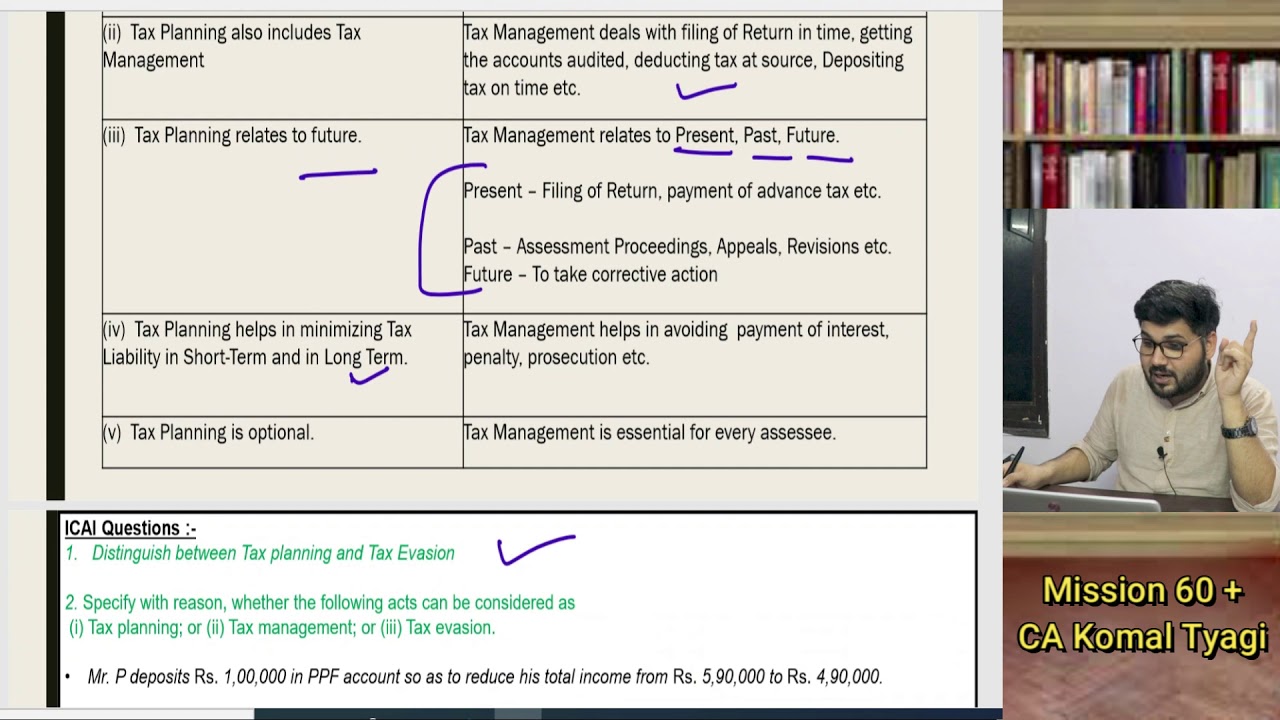

Ctp Ques 1 The Difference Between Tax Planning And Tax Management Tax Planning Tax Management I The Objective Of Tax Planning Is To Minimize The Course Hero

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu

Aggressive Tax Planning And Corporate Tax Avoidance The Case Study Semantic Scholar

What Are The Differences Between Tax Planning And Tax Avoidance

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership